Starting in April, many landlords and some banks deferred rental and mortgage payments, respectively, for 3-4 months, but they are not likely to do so much longer. A number of states are addressing what could be the largest increase in the homeless population in 40 years (since the courts, abetted by the Reagan administration, mandated the closure of hundreds of what we used to call mental institutions) by imposing a moratorium on evictions. This is the wrong way to approach the problem. Landlords should not be forced to bear the burden of zero rental income just because government is incapable of intelligent action. They must continue to pay property taxes, insurance, utility bills and other running expenses whether or not they are receiving rental income.

Here is what needs to happen. Congress should enact legislation—a Housing Protection Act (HPA)—comparable to the Paycheck Protection Act (PPA) that provided loans to employers that they do not have to pay back if they keep their employees on the payroll. Translated to housing, landlords would receive similar loans that could become grants if they allowed their tenants to remain in their rental units. Something similar needs to be done for mortgagors who face eviction if they are unable to meet their monthly mortgage payments.

Unlike PPA loans, which were rife with confusion, favoritism and application turn-downs by banks, HPA loans should be administered and awarded directly to applicants by either one of the bank regulatory agencies or the Consumer Financial Protection Bureau, cutting out banks as middlemen.

The wealthiest nation on Earth can well afford to come to the rescue of its citizens for the duration of this crisis. This is hardly the time to be fretting about increasing the national debt, something both political parties have ignored for 20 years. The time to address debt issues is when the economy is strong. The failure to do that over the last 6-7 years when we experienced a good economy was irresponsible. Moreover, cutting taxes when every responsible economist and public policy analyst called for raising them on rich Americans was a dereliction of duty by both Congress and the president. If we could afford that hit to the national debt, we can certainly afford one that benefits a much wider demographic.

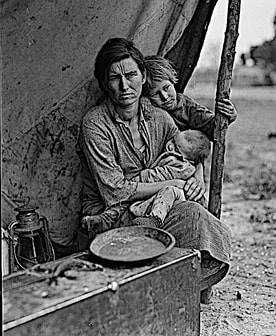

But that’s all water over the dam. What we need now is bold and immediate action to stave off an imminent crisis. 4.3 million homeowners missed their May mortgage payments, and more than 665,000 of them are three months in arrears. Banks that deferred mortgage payments are not inclined to forbear any longer. If our political leaders don’t address this problem immediately, we risk adding millions of Americans to the homeless population (the Department of Housing and Urban Development says that 553,000 Americans are currently homeless)—a disaster that will haunt us for years to come and end up costing multiples of what it would cost now to enable them to remain under their own roofs until the current health and economic crises pass. The rending of what little remains of the social fabric that will result will be hard, if not impossible, to repair.

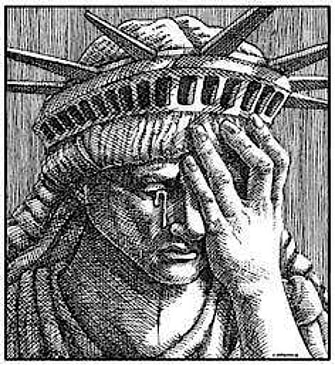

Don’t expect the Trump administration to take the initiative to get something like this done. It has failed at every decision point along the way during the coronavirus, economic and racial turmoil that have made our country the poster child for how not to run a government. It is up to Congress to act…and act now.

Dick Hermann

June 26, 2020

RSS Feed

RSS Feed